Travel Insurance for the Camino de Santiago

Disclaimer: These are my personal opinions based on my travel experiences. This is not a recommendation to buy travel insurance. If you make a purchase after clicking an affiliate link, I may receive a small compensation at no cost to you.

Are you walking the Camino de Santiago soon and wondering if you need Camino de Santiago travel insurance? Read on for more info!

Whether you are just booking your trip on the Camino de Santiago or are sitting in a hostel in Sarria wondering, “Should I get travel insurance for the Camino?” you’re in the right place.

This article will review why we think it’s essential to purchase travel insurance for walking the Camino de Santiago pilgrimage along with two insurance options.

Short on time? Get a quote for Camino travel insurance now ⤵

In the end, it’s up to you if and where you choose to get travel insurance cover — but if you do, we’d like to introduce you to the best insurance for the Camino: Safetywing and one other option: World Nomads!

Do I need travel insurance for the Camino de Santiago?

First things first, many people wonder if they even need travel insurance — for any type of travel, not just the Camino routes.

Let’s just say that travel insurance it’s like any type of insurance: you likely won’t need it, but you don’t want to be left without insurance if you need it.

If there’s one thing in life (and travel) that’s certain, it’s that nothing is certain! Although we make our plans, stuff happens. Since my Dad started his travel agency when I was just seven years old, I’ve seen and heard it all. For instance, luggage gets lost or damaged, planes are canceled, and illnesses and injuries happen abroad.

I’ve also seen all sorts of things on the Camino de Santiago, including lots of injuries. I was actually shocked when I showed up on the first day of the Camino Frances and saw so many people with bandaged knees and feet!

Additionally, I met people that suffered from severe bug bite reactions and even heat exhaustion that needed medical attention that required health insurance.

Walking the Camino de Santiago is no joke! You really do need to train, plan, and, most importantly, listen to your body.

Anyhow, we think it’s better to spend a few extra dollars now getting travel insurance than be out hundreds — or thousands — when an unforeseeable event occurs.

Top Choice for Camino de Santiago Insurance: Safetywing

In our opinion, SafetyWing is an ideal travel insurance provider for embarking on the Camino de Santiago pilgrimage.

Created by digital nomads who understand the unique needs of travelers, SafetyWing offers a flexible and affordable solution specifically tailored to address the challenges faced during long-distance walks like the Camino de Santiago.

1. Coverage Highlights for Camino de Santiago

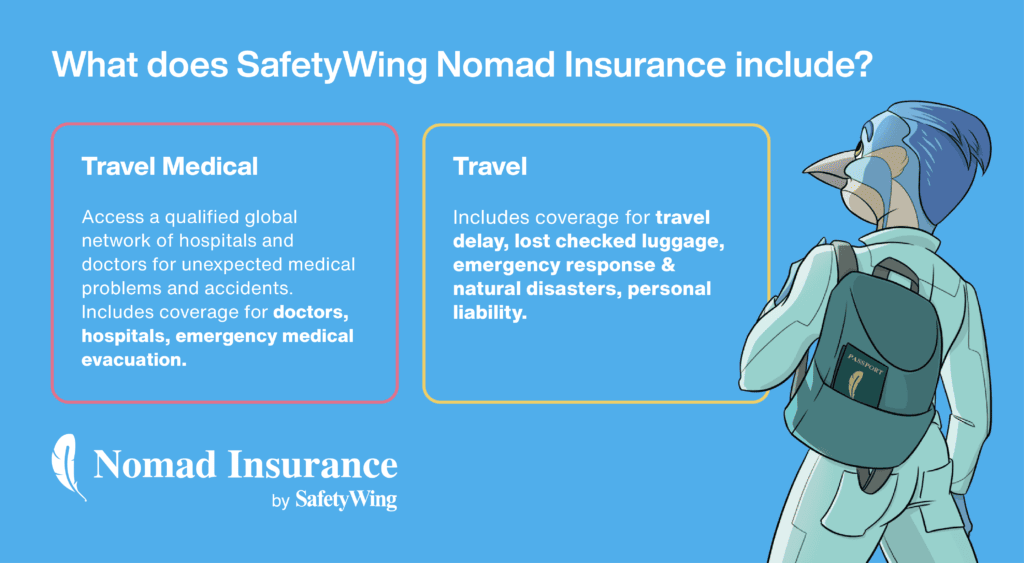

SafetyWing’s travel medical insurance provides comprehensive coverage to ensure a worry-free experience along the Camino de Santiago.

Here are some coverage highlights:

- Robust Coverage: SafetyWing’s policy covers unexpected illness or injury, including expenses related to hospital visits, doctor consultations, and prescription medications (where eligible). Additionally, it covers travel delays and lost checked luggage. Plus, it offers protection during non-professional sports and activities!

- Extensive Network: SafetyWing provides coverage in all countries worldwide, except for Iran, North Korea, and Cuba (excluding Cuban citizens). In other words, you can rely on their insurance in Spain.

- Ample Coverage Amount: SafetyWing offers up to $250,000 in coverage with a deductible of only $250! This ensures financial protection in the event of significant medical expenses or emergencies.

- Long-Term Coverage: SafetyWing allows you to stay subscribed for the long term without the need to determine the duration of your trip in advance. This allows for continuous coverage throughout your Camino de Santiago journey as a Safetywing member.

2. Additional Benefits for Camino de Santiago Travelers

SafetyWing’s travel insurance offers additional benefits that are particularly valuable to Camino de Santiago walkers:

- Access to Private Healthcare Providers: In areas where the public healthcare system may be limited along the Camino de Santiago route, SafetyWing provides the option to seek treatment from private healthcare providers. This ensures access to quality medical services if needed.

- Coverage in Home Country: SafetyWing includes limited coverage in your home country, except for appointments related to pre-existing conditions. This means that if you need to interrupt your Camino, you have 30 days of at-home accident coverage (or 15 days in the USA) during every 90-day cycle.

3. Important Considerations for Camino de Santiago Travelers

Before purchasing a SafetyWing plan for the Camino de Santiago, there are a few factors to consider:

- Age Limit: SafetyWing has an age limit. Unfortunately, travelers over the age of 69 cannot purchase a plan. Make sure that you fall within the age requirements before proceeding with your insurance selection.

- US Coverage: If for some reason you plan to visit the United States during or after your Camino de Santiago journey, note that separate coverage is required. You will need to cancel your existing plan and purchase a new one specifically tailored for US coverage, which will also reset your deductible.

It is essential to review the full policy details provided by SafetyWing to understand all coverage specifics, exclusions, and terms and conditions relevant to your Camino de Santiago travel needs.

Camino Travel Insurance Option: World Nomads

World Nomads is another option when it comes to travel insurance. With plans for people under 70, it’s designed for adventurous travelers with coverage for overseas medical, evacuation, baggage and a range of adventure sports and activities.

Here are seven things we’d like you to know about World Nomads when it comes to insurance for the Camino de Santiago (or any type of active travel, really!).

1. Trusted reliable underwriters

World Nomads employs a team of strong, secure, specialist travel insurers. Without a doubt, these insurers provide great coverage. Plus, you’ll have access to 24 hour emergency assistance, a must for when you’re out on the trail. The company offers the very highest levels of support and claims management when you need it.

2. Value for money with the cover you need

Although they could provide coverage for everything but the kitchen sink, World Nomads focuses on coverage for what’s important for travelers (particularly in adventure travel).

By providing what you need and leaving out what you don’t, World Nomads prices are some of the most competitive prices you’ll find online. Get a quote.

3. Flexibility when you need it on the Camino

We all know that plans can change. Sometimes it means an extra night somewhere because of a delayed plane. Every so often, I even hear of people leaving the Camino early — sometimes due to injury, family obligations, or just realizing the journey wasn’t what they thought it would be. (While insurance doesn’t typically cover, “I changed my mind,” you get the point. Things happen, and plans change.)

With World Nomads, you can always buy more coverage while you’re still away. Or, you can get a new World Nomads policy even if you’re already traveling! This is so useful, as in my experience, many providers require you to purchase before your travel dates begin.

You can also start your claims online while you are still away, perfect for getting a jump start on expensive reimbursements.

4. Coverage for a range of adventure activites

From backpacking Europe to biking to road tripping, WorldNomads.com covers a range of adventure activities. Of course, for our purposes, hiking and trekking are covered!

World Nomads also covers volunteering, vacation rentals, and working abroad. If you’re doing any of these activities before or after you Camino, it’s certainly worth a look at their coverage options.

5. World Nomads keeps you traveling safely along the Camino

On WorldNomads.com, you’ll find the World Nomads Travel Safety Hub. Here, you can access up-to-date travel safety alerts, as well as travel safety advice and tips.

You will probably be particularly interested in their Spain safety alerts page.

6. Other helpful features in addition to insurance

We are huge proponents of learning a bit of the local language whenever we travel. And, so is World Nomads! Learn a few words for your travel with their iPod & iPhone Language Guides.

Additionally, you may stay in touch with family and friends with their online travel journal.

7. Commitment to exceptional customer service

Still not sure that travel insurance is important for your Camino de Santiago trip? World Nomads is committed to providing exceptional customer service when you need it most.

If you have any questions about how to select travel insurance or travel safety in general, feel free to contact WorldNomads.com directly.

Last Thoughts on getting insurance for the Camino de Santiago

We hope that this page on Camino de Santiago insurance has been helpful to you as you plan your journey on the Camino Frances, Camino Portugues, or any other Camino route!

Whether it’s Safetywing, World Nomads, or any other travel insurance provider, consider purchasing coverage.

If nothing else, the peace of mind of knowing you’re covered by insurance while walking the Camino de Santiago is worth something!

More Camino Tips & Information

For more information on the Camino, check out our other articles.

- Ultimate Guide to the Camino de Santiago

- Camino de Santiago Albergues: All About Accommodation

- How much does the Camino de Santiago cost?

- 5 Interesting Reason Why People Walk the Camino

- Packing List for the Camino de Santiago

Pin it!